Forex trading simulators are powerful tools that allow aspiring and seasoned traders alike to practice their skills without the financial risks associated with actual trading. If you are seeking reliable resources, you should consider forex trading simulator Trading Brokers in Turkey. They often offer demo accounts equipped with top-notch simulators that can accelerate your learning process.

The Importance of Forex Trading Simulators

In an ever-evolving landscape, where market movements can change within seconds, having a solid foundation in trading strategies is crucial. Forex trading simulators provide traders with the opportunity to experience real-time market conditions without the fear of losing real money. This can be an invaluable tool for anyone looking to step into the world of forex trading.

What is a Forex Trading Simulator?

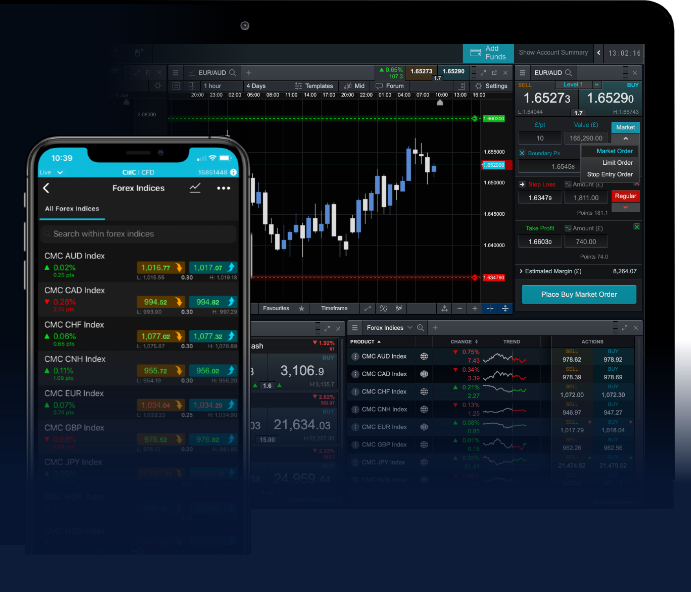

A forex trading simulator is a platform that mimics real-life trading in the foreign exchange market. It allows users to execute trades using virtual currency in real-market conditions. Generally, these simulators come with a user interface that resembles actual trading platforms, providing a familiar environment for traders. They often include various tools and features to analyze market trends and make informed decisions.

Benefits of Using a Forex Trading Simulator

- Risk-Free Learning: Perhaps the most significant advantage is the ability to practice trading strategies without the risk of financial loss. Traders can experiment with different approaches to see what works best for them.

- Developing Strategies: A trading simulator allows you to develop and test your trading strategies rigorously. Whether you’re interested in day trading, swing trading, or long-term investment, you can simulate different scenarios with various market conditions.

- Understanding Market Dynamics: Forex trading simulators provide real-time data and analytics, enabling users to experience and understand the complexities of market dynamics and price movements.

- Improving Decision-Making: By practicing in a risk-free environment, traders can enhance their decision-making skills, gaining the confidence needed for live trading.

- Measuring Performance: Many simulators offer reporting tools to track performance over time. This feedback can help traders identify strengths and weaknesses, allowing for further refinement of their strategies.

Choosing the Right Forex Trading Simulator

When choosing a forex trading simulator, several factors deserve consideration:

- User Interface: A user-friendly interface can make a considerable difference in the learning experience. Ensure that the simulator is easy to navigate and understand.

- Realism: The simulation should closely replicate the actual forex market, including spreads, slippage, and various trading scenarios.

- Support and Resources: The best simulators come with educational resources, tutorials, and customer support to assist users in making the most of the platform.

- Customization: Look for simulators that allow you to customize trading conditions, such as leverage, account types, and more.

How to Get the Most Out of Your Forex Trading Simulator

Even though a simulator provides a practice environment, it’s essential to approach it with the same dedication and discipline as you would with real trading. Here are strategies to maximize your simulator experience:

- Set Clear Goals: Establish your learning objectives. Whether it’s mastering a particular trading strategy or understanding market analysis, clear goals will guide your practice sessions.

- Follow a Trading Plan: Treat your simulator as a live trading environment. Implement a comprehensive trading plan to develop discipline and consistency.

- Analyze Your Trades: Regularly review your trades to assess what worked and what didn’t. This post-analysis is crucial for growth.

- Gradually Increase Difficulty: Start with basic setups and slowly introduce more complexities as you become comfortable with the platform.

Transitioning to Live Trading

After gaining sufficient experience in a simulator, the next step is transitioning to live trading. It is essential to remember that the transition may come with emotional challenges that weren’t present in the simulator due to the lack of financial risk. Here are tips for a smooth transition:

- Start Small: Avoid the temptation to trade large amounts initially. Start with smaller trades to get accustomed to live trading dynamics.

- Stick to Your Plan: Ensure you adhere to the trading plan established during your simulator practice, maintaining consistency in your approach.

- Manage Your Emotions: Live trading can invoke strong emotions, especially during losses. Having strategies in place to manage these emotions is essential for long-term success.

Conclusion

Forex trading simulators are an indispensable resource for anyone serious about entering the forex market. They provide a risk-free environment to practice and hone trading skills, ensuring that when you finally transition to live trading, you are well-prepared and confident. By utilizing a simulator effectively, you can enhance your understanding of trading strategies and market dynamics, setting yourself up for a successful trading journey. Remember, continuous learning and adjusting your approach based on experience will keep you ahead in the competitive world of forex trading.