Your Comprehensive Guide to Forex Trading Education

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies in the global marketplace. Understanding the intricacies of forex trading is crucial for anyone looking to navigate the financial markets effectively. This guide aims to provide a comprehensive overview of forex trading education, offering essential concepts, strategies, and resources to help both beginners and experienced traders enhance their skills. To delve deeper into forex trading, you may find valuable resources on forex trading education exglobal.pk.

Understanding the Basics of Forex Trading

The foreign exchange market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike stock markets, forex is decentralized, meaning that buying and selling occur directly between parties, typically through electronic trading platforms. The primary entities involved in forex trading include banks, financial institutions, corporations, governments, and individual retail traders.

Currency Pairs

Forex trading always occurs in pairs. Each trade involves buying one currency while simultaneously selling another. Currency pairs are categorized into three main types:

- Major Pairs: These include the most traded currencies, such as EUR/USD, USD/JPY, and GBP/USD.

- Minor Pairs: These pairs consist of currencies that are less frequently traded, like AUD/NZD and GBP/CAD.

- Exotic Pairs: These involve a major currency paired with a currency from an emerging or smaller economy, such as USD/SGD or EUR/TRY.

Pips and Lots

In forex trading, a “pip” refers to the smallest price move that a given exchange rate can make based on market convention. The term “lot” refers to the size of the trade. Traders can select from different lot sizes, including standard lots (100,000 units), mini lots (10,000 units), and micro lots (1,000 units). Understanding how pips and lot sizes work is essential for managing risk and calculating profits or losses.

Key Concepts in Forex Trading

Several fundamental concepts are vital for aspiring forex traders to grasp. These include:

Leverage

Leverage allows traders to control larger positions with a smaller amount of capital. For example, a leverage ratio of 100:1 means that for every dollar a trader puts down, they can control $100. While leverage can amplify profits, it also increases the risk of substantial losses.

Margin

Margin is the amount of money required to open a position with leverage. It’s a portion of the trader’s account balance set aside to cover potential losses. Understanding margin requirements is essential for maintaining a healthy trading strategy.

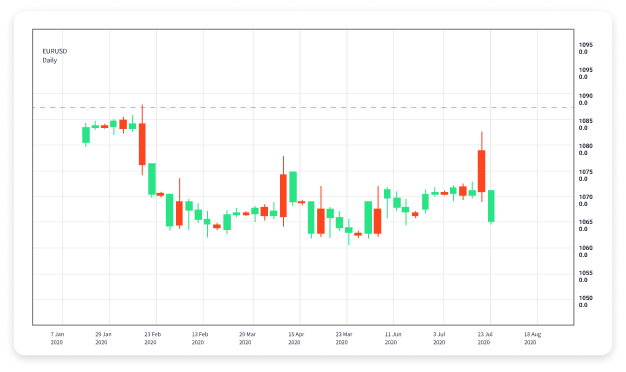

Technical Analysis

Technical analysis is the study of past market data, primarily price and volume, to forecast future price movements. Traders often use various charting tools and indicators to make informed decisions. Some popular tools include moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels.

Fundamental Analysis

Fundamental analysis involves evaluating economic indicators, news events, and geopolitical factors that can impact currency values. Key indicators include interest rates, employment figures, inflation data, and GDP growth. Successful traders often combine both technical and fundamental analysis for a more comprehensive understanding of market trends.

Developing a Trading Strategy

A well-defined trading strategy is essential for any forex trader. Here are the key steps to developing a robust trading plan:

1. Identify Your Trading Style

There are several trading styles, including scalping (short-term trades), day trading (holding positions within a single day), and swing trading (holding positions for several days or weeks). Choose a style that best fits your personality and time commitment.

2. Set Clear Goals

Establish what you want to achieve through forex trading. This could be a specific percentage return on your investment or a set amount of profit over a certain period. Having clear goals will help you remain focused and disciplined.

3. Risk Management

Effective risk management is crucial to long-term success in forex trading. Determine how much of your capital you are willing to risk on each trade, typically no more than 1-2%. Use stop-loss orders to limit potential losses and protect your capital.

4. Keep a Trading Journal

Maintaining a trading journal helps you track your trades, analyze your performance, and identify areas for improvement. Record your reasons for entering and exiting trades, your emotions during trades, and the outcome of each trade to refine your strategy over time.

Education and Resources for Forex Trading

Continuous education is key to becoming a successful forex trader. Many resources are available online, including:

Online Courses

There are numerous online platforms offering courses on forex trading, covering everything from basic concepts to advanced strategies. Look for courses that include practical exercises and trading simulations.

Trading Forums and Communities

Engaging with other traders can provide valuable insights and share strategies. Online forums and social media groups can be excellent places to learn from others’ experiences.

Books and eBooks

Many authors have published books dedicated to forex trading education. Some classic titles include «Currency Trading for Dummies» and «Day Trading and Swing Trading the Currency Market» by Kathy Lien. These resources can provide in-depth knowledge and strategies.

Webinars and Live Trading Sessions

Many brokers and educational platforms offer webinars and live trading sessions where experienced traders share their strategies and insights. Participating in these events can enhance your understanding of market dynamics and trading methods.

Conclusion

Forex trading can be a rewarding venture, but it requires a well-rounded education, disciplined strategies, and a commitment to continuous learning. By understanding the basics of forex trading, developing a solid trading strategy, and utilizing available educational resources, you can increase your chances of success in this dynamic and exhilarating market.